Easy Online Estate Planning Just Got Easier!

After a world-changing 2020, people are starting to realize the value of legacy planning. The biggest mistake you can make is thinking you don't have enough property to plan your estate. No matter your net worth, you need the proper documentation to dictate your end-of-life wishes for your finances, healthcare, and even guardianship. NetLaw Legacy is here to provide you with an easy solution for the hard questions in life.

The 3 BIG legacy ?'s...

Who'll care for your kids?

Without naming a Guardian, a judge will decide who will have custody and control of your children and their inheritance. Naturally, you want to ensure your kiddos go to the person you trust the most. If you wish to avoid custody battles between family members, you should plan your estate.

What happens to your property?

Suppose you bought a house or car that you want to remain in the family when you pass away. No biggie! After some time in public court, your assets and bank accounts may finally be accessible to the right person. Or maybe not. If you want to avoid uncertainty, you should plan your estate.

Who has the

power?

Asking "who has the power" may sound like a silly question initially. However, suppose you become incapacitated for any reason. In that case, you need to have someone you trust appointed to make medical and financial decisions on your behalf. Needless to say, you should plan your estate.

the legacy suite

Last Will & Testament

Also called a Will, this document dictates debt arrangements and asset distribution at death. Your Will is also crucial for naming a guardian for minor children and a personal representative (executor) to oversee the settlement of your estate.

Living Trust

Or Revocable Living Trust is a document often paired with your Will to minimize court proceedings and public records. Certain assets and funds are distributed through your Trust instead of your Will to avoid probate court and maintain privacy.

Power of Attorney

This document names and authorizes those responsible for making financial decisions and transactions if you are incapacitated.

Health Care Surrogate Designation

Or a Health Care Power of Attorney is a document that names a person to make healthcare decisions if incapacitated.

HIPAA Authorization

"HIPAA" is the Health Insurance Portability and Accountability Act of 1996. This federal law protects your private medical and mental health information. Your HIPAA Authorization designates a person or party that may receive access to your confidential medical and mental health information.

Living Will Declaration

Also called Advance Directive instructs your physicians and loved ones whether to keep you alive or not if you are permanently unconscious or have a terminal condition

Give Legacy a try!

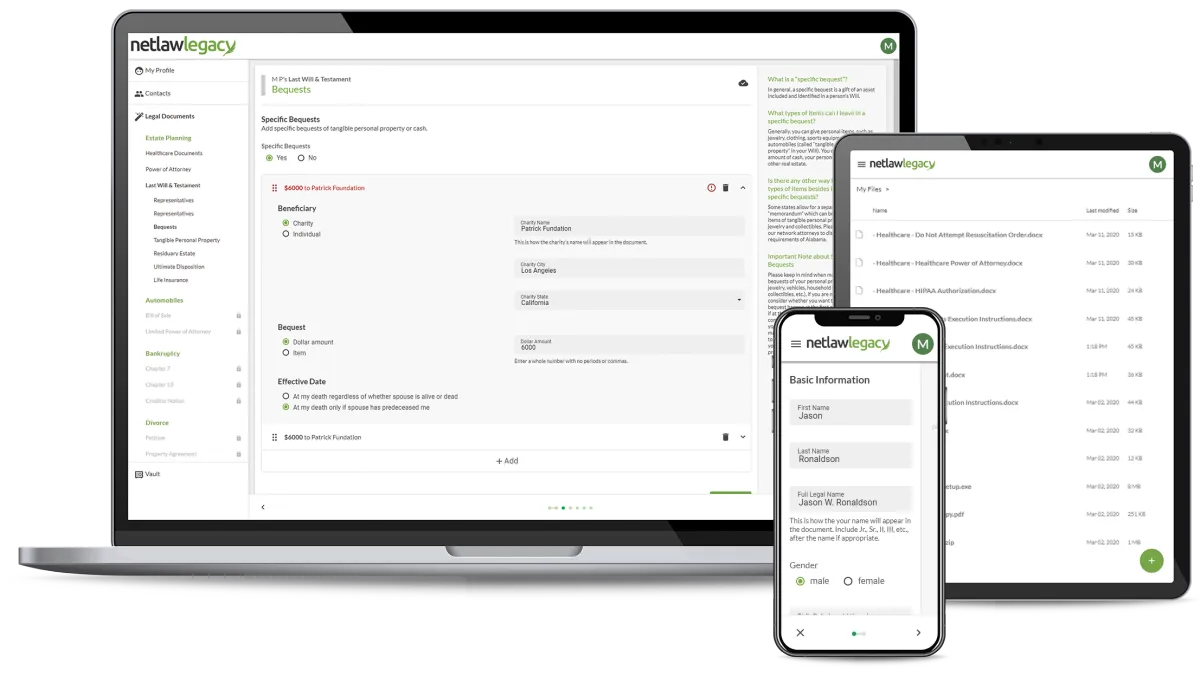

NetLaw Legacy is your comprehensive online estate planning solution. Quickly create attorney-backed legal documents from the comfort of your sofa without any legal background of your own. Whether stationary or on the go, you can access your account with any device without downloading an app!

Next Steps

Sign up for NetLaw Legacy App using your Agent's referral code (automatically entered when you sign up below)

Fill out your family profile

Use a dropdown to make elections quickly

Assemble and execute your documents in minutes

Upload your completed documents in your complimentary cloud storage for easy access

Hector Sanchez

Licensed Insurance Advisor

hector@projectblade.life

+1(619)762-1102

https://projectblade.life

Hector Sanchez

Licensed Insurance Advisor

Website

info@projectblade.life

+1(877)357-6407

https://projectblade.life

Copyright © 2026 Project B.L.A.D.E., All rights reserved.

Project B.L.A.D.E. is a financial education organization not an insurance agency. Life Insurance services provided by Hector Sanchez, Licensed Insurance Advisor - National Producer #12285329.